My wife and I had been called by his teacher for an urgent meeting.

Our six-year-old daughter gave her parents and me a note that she had written. My wife and I cooperated with his teacher’s request to enter the classroom for an impromptu discussion, and she asked us to do so.

When we asked our child if he knew why, he replied, “She didn’t like a drawing I did.” When we asked him whether he knew why, this was his response.

We then continued interrogating him to see if he had any more ideas.

We reported for duty the next morning and began working right away.

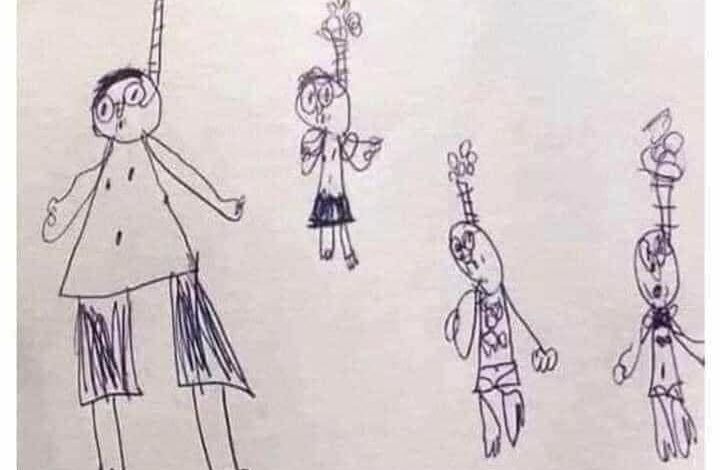

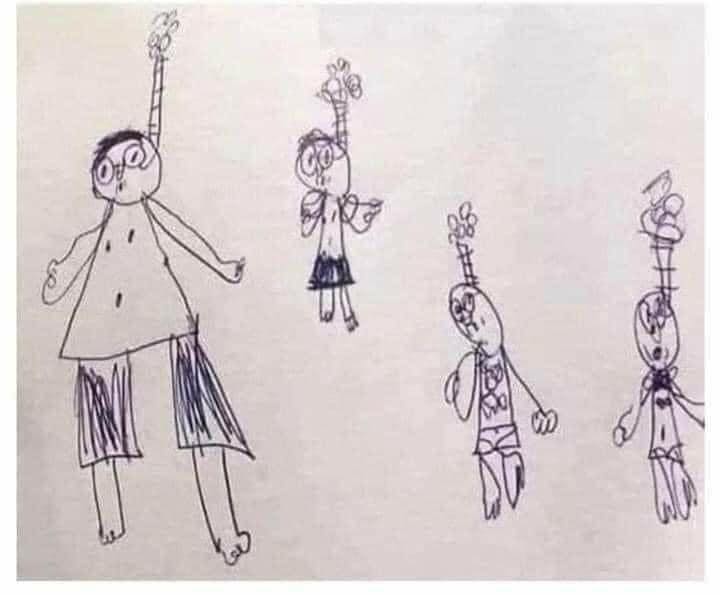

His teacher handed him the painting beneath it and explained that she had asked him to depict his family and that he had fulfilled her request in the presented painting. Would you kindly provide me with more details about that?

My wife’s response, which I was expecting, was “Not at all.” A departure from the typical activities with the family. Just a short distance off the Bahamas coast is where visitors can go snorkeling.

Key Considerations When Choosing Health Insurance for Seniors

- Health Needs Seniors should assess their current and anticipated healthcare needs. Those with chronic conditions or frequent medical appointments may require comprehensive coverage, including prescription drug plans or Medigap policies.

- Budget Premiums, deductibles, and out-of-pocket costs vary across different insurance plans. Seniors should choose a plan that fits their budget while also providing the coverage they need. Medicare Advantage plans and Medigap policies offer a range of prices, allowing seniors to find the right balance of cost and coverage.

- Prescription Drug Coverage Prescription medications can be a significant cost for seniors. Those with ongoing medication needs should carefully evaluate Medicare Part D plans or Medicare Advantage plans that include drug coverage. Make sure the plan covers the specific drugs required and has favorable terms for cost-sharing.

- Access to Providers Seniors should ensure that the insurance plan they choose allows access to their preferred doctors and specialists. Some Medicare Advantage plans may have restricted provider networks, so it’s important to confirm that desired healthcare providers are in-network before selecting a plan.

- Long-Term Care Medicare does not typically cover long-term care, such as extended nursing home stays or in-home care services. Seniors who anticipate needing long-term care may want to consider additional options, such as long-term care insurance, which can help cover the costs associated with these services.

- Annual Enrollment Period Medicare offers an Open Enrollment Period from October 15 to December 7 each year, during which seniors can review and change their Medicare Advantage or Part D plans. During this period, seniors can switch plans, drop coverage, or enroll in new coverage based on their changing healthcare needs.

The Importance of Preventive Care for Seniors

Most health insurance plans, including Medicare, offer free preventive services to help seniors stay healthy. These services may include screenings for chronic diseases like diabetes or cancer, vaccinations, and annual wellness visits. Preventive care can detect health issues early, allowing for better management and potentially reducing overall healthcare costs.