The Sad Story of Phillip Herron: A Call for Compassion

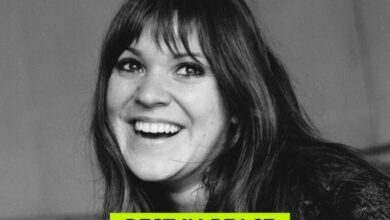

The story of Phillip Herron is a heartbreaking tale of a single father, unable to handle the pressure of rising debt and providing for three young children. Sadly, an image of him moments before taking his life, alongside his story, has gone viral as it sheds light on the importance of good mental health and a strong support system for men.

Phillip Herron Ends His Life

Sadly, boys are raised to believe that showing any emotion or vulnerability is a sign of weakness. As such, men rarely discuss the weight of their stresses or address how to find support. They’re often embarrassed or ashamed when they shed tears or have to ask for help. However, the story of Phillip Herron reminds men to be kinder to themselves and women to be compassionate regarding their plights.

Hopelessness Takes Over

Phillip Herron was a father of 3 children, struggling to make ends meet, and facing a burdening debt of more than $20,000. In the image, taken moments before his death, he’s sitting in a car, looking hopeless and heartbroken, tears streaming down his face.

A Heartbreaking Feeling

The father wasn’t only in debt but had also been waiting on a delayed payday loan. Phillip Herron had a mere $4.61 in his bank account, at the time of his death. Additionally, he was concerned about telling his children there would be no visit from Santa this year. The heartbroken father noted in a suicide letter that “his children would be better off without him.”

Men Need Support Too

Phillip Herron’s story is heartbreaking but sheds light on issues that impact an alarming majority of the population. Firstly, it points out the negative effects of a rise in costs, while income and benefits have remained the same, or been cut in some cases. Secondly, Phillip Herron’s story highlights men’s daily struggles, feeling there’s no one they can turn to in times of crisis but need good mental health and support too!

Contrary to popular belief, it’s common for men to experience mental health issues such as depression, anxiety, or burnout. Rather, 1 in 10 suffers from these issues but less than half will get treatment. Meanwhile, men are 4 times more likely to die by suicide annually, than women. Additionally, symptoms differ for men and women, with men often feeling more societal pressure to be a provider.

Adverse Effects

Like women, men can face further health risks when they’re suffering from mental health disorders. Some examples include:

- Substance abuse or other addictive behaviors

- Problems with the digestive tract

- Heart disease

- Sleep disorders

- An increased risk of stroke

- Rapid changes in weight

Read More: 15-year-old dies by suicide 2 days after telling his mom he was being bullied at school

Maintaining Mental Health

Because of the stigma regarding men’s health, it’s often difficult for them to address their “inner demons” or wounds. However, they’re not immune to emotions or mental struggles and need support like women do. Yet there are limited resources regarding supporting men like Phillip Herron. Fortunately, awareness and desire for change are increasing and men are gaining more allies. In the meantime, some steps can be taken to help facilitate good mental health.

Crucial Steps

- Maintain friendships

- Identify your support system

- Identify and eliminate unhealthy coping skills

- Find healthy hobbies

- Stay physically active and practice gratitude, mindfulness, or breathing exercises to help ground you and maybe find a new perspective.

- Lastly, (but perhaps most importantly) validate your feelings.

Making time for friendships develops a bond, reinforcing the idea that someone is there for you in tough times, simultaneously while helping you identify your tribe. Plus, healthy hobbies are something friends can do together, getting a break from the stresses of life as well.

Women Have Habits and Supports

Although the struggles of men and women differ, no one is immune to mental health disorders. However, statistically speaking, women have more outlets than men. They’re more social, often having one another to lean on. Furthermore, they’re more likely to join groups with a powerful feminine energy like a book club or morning yoga class in the park. As such, creating a sense of community seemingly helps to stave off certain mental health problems. It’s a model worth considering as men figure out their feelings, matter and should be validated too. While it may be uncomfortable, taking time to identify your feelings and why they matter is a great place to start on the journey to achieving good mental health.

Supporting One Another

Being a single parent is difficult for anyone, let alone having three children. These feelings are normal and nothing to be ashamed of. Phillip Herron struggled with the stresses he faced without feeling like he had a source of support. According to reports, his friends and family had no idea he was having such a tough time. This is more common than most people are aware of. As such, checking in on the people we love and reminding them they’re important. Support is essential, whether or not they’re comfortable with vulnerability or what their gender is. We’re all people who feel a complex range of emotions. It’s tough to navigate that range if society always tells you not to.

Can you use life insurance to build wealth?

One type of policy features a savings component

Life insurance is often viewed as a crucial form of protection, helping grieving family members cushion the financial impact of losing a loved one. With the right policy, this type of cover can assist families in paying off loans and debts, as well as provide them with the monetary means to meet daily living expenses.

However, this kind of financial benefit is just one of the several elements of life insurance. Like other types of policies, it is a complex investment with its share of benefits and drawbacks – and depending on how it is managed, life insurance can also be used as an effective strategy to build wealth.

How does life insurance work?

Life insurance plans are available in several variations but generally fall into two categories – term and permanent policies. Each comes with its share of pros and cons and the key to determining whether one is a good investment is understanding how it works.

Term life insurance

As the name suggests, this type of policy covers the policyholder for a set term. It pays out a stated amount, called death benefit, if the insured dies within a specified period, meaning they can only access the payment in the years that the plan is active. Once the term expires, the policyholder has three options: renew the policy for another term, convert it to a permanent coverage, or terminate the plan.

Permanent life insurance

Unlike term life insurance, a permanent policy does not expire. It comes in two primary types – whole life and universal life plans, which combine the death benefit with a savings component.

Whole life insurance policies offer coverage for the entire lifetime of the insured and the savings can grow at a guaranteed rate. Universal life insurance, meanwhile, uses different premium structures, with the earnings based on how the market performs.

What are the benefits of permanent life insurance?

One of the main advantages of a permanent life insurance policy is that it can be used as an investment tool to accumulate wealth. Here are some other benefits of this type of coverage, according to the financial website Investopedia.

1. Tax-deferred growth

Permanent life insurance allows the policyholder to invest on a tax-deferred basis, meaning they are exempt from paying taxes on any interest, dividends, or capital gains on the plan’s cash value, unless they withdraw the proceeds.

“This is similar to the tax benefits you get with certain retirement accounts, including IRAs, 401(k)s, and 403(b)s,” Investopedia explained. “If you’re maxing out your contributions to these accounts year after year, investing in permanent life insurance for tax reasons may make sense.”

2. Lifetime coverage

Permanent policies cover the insured for life, unlike term life insurance, which ends coverage after a set number of years.

“If you anticipate people being financially dependent on you beyond the length of a typical term policy – for example, a disabled child – this benefit may be attractive to you,” the financial website noted.

3. Access to cash value

Policyholders can borrow against the cash value of a permanent life insurance policy if the need arises without incurring penalties, unlike in tax-advantaged retirement plans such as 401(k).

4. Accelerated benefits

Insureds may be able to receive between 25% and 100% of their policy’s death benefit even if they are still alive if they develop a critical illness – including invasive cancer, heart attack, renal failure, or stroke – and use the money to pay for medical bills.

Investopedia pointed out, however, that these benefits are not unique to permanent life insurance, adding that people can often access these in other ways “without paying the high management expenses and agent commissions that come with permanent life insurance.”

What are the drawbacks of a permanent life insurance policy?

Cost is among the biggest drawbacks of permanent life insurance plans. It requires policyholders to pay higher premiums compared to term life coverage. Permanent policies can also have tax implications if the beneficiaries opt to surrender coverage or if the insured dies with outstanding loans. Additionally, borrowing from the cash value or accessing accelerated benefits can reduce the payout amount.

How can policyholders build wealth through life insurance?

Permanent life insurance plans enable policyholders to accumulate cash value in addition to the death benefit. They can use these funds to pay their premiums, take out a loan at a lower rate than banks offer, and supplement their retirement income. Additionally, according to Investopedia, insureds can utilize the cash value built-up in their policies to “create an investment portfolio that maintains and accumulates wealth.”

But how exactly do permanent life plans build up cash value? According to the financial website, cash value accumulates as the premiums policyholders pay are split up into three portions. One part of the payment goes toward the death benefit, another covers the insurer’s operating costs and profits, and the rest is allotted to the plan’s cash value.

“The life insurance company generally invests this money in a conservative-yield investment,” Investopedia noted. “As you continue to pay premiums on the policy and earn more interest, the cash value grows over the years.”

Accumulation, however, slows down over time.

“In the early years of your policy, a larger portion of your premium is invested and allocated to the cash value account,” the financial website explained. “Generally, this cash value can grow quickly in the early years of the policy. Then in later years, the cash value accumulation slows as you grow older and more of the premium is applied to the cost of insurance.”

Investopedia added that cash value accumulation varies depending on the type of policy. Whole life plans, for instance, offer guaranteed cash value accounts that “grow according to a formula the insurance company determines,” while universal life policies build up cash value based on current interest rates.

The table below illustrates how a cash value accumulates in a $100,000 whole life insurance policy with premiums paid out of pocket starting at 35-years old for a non-smoking male.