‘Britain’s Most Tattooed Man’ Shares What He Looked Like Without Ink, And You Better Sit Down

Tattoos have the potential to totally transform someone’s look.

This is the reason it’s so intriguing to view the pre-inking photos of the world’s most inked individuals.

The mom with over 800 tattoos, Australia’s most tattooed model, and the notorious “Black Alien” have already left us in awe.

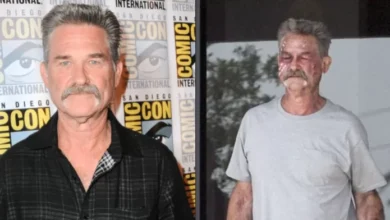

However, the man known as “Britain’s most tattooed man” has since revealed an unrecognizable photo of himself from before he earned the title.

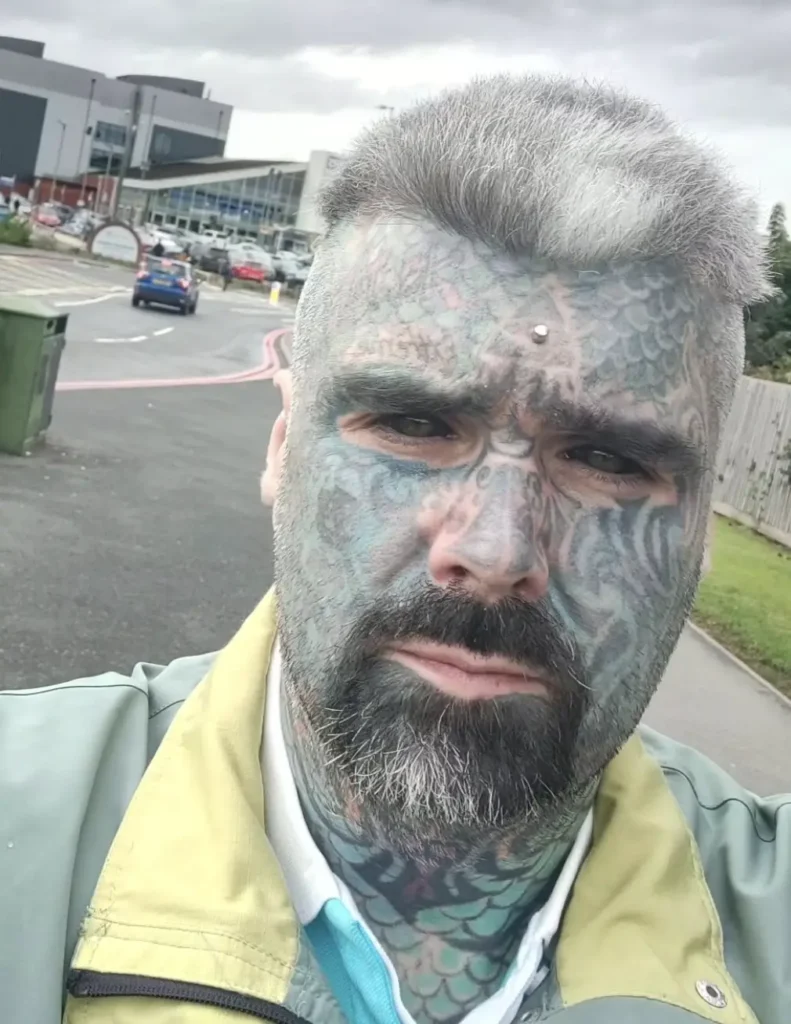

Known as the “King of Inkland King Body Art,” Matthew Whelan is more than just a body painter.

He’s a fan of other forms of body modification, telling his social media fans (as per the Mirror): “I alter my body, that is well established.”

His unusual appearance has, however, been putting his health at risk.

He explains: “My transdermal implant (not micro dermal skin nip) surgical procedure is and has always been a 24/7 open wound and from time to time can bleed, get inflamed, scab, or seep plasma.”

“I don’t believe it to be an infection; however, the body is trying to heal an unwarranted hole punctured in it and a foreign object (a titanium disc and body jewellery), so it could just be the body mod version period just at that time of the month.”

“Jokes aside, ladies, I know some of you suffer really badly in those.”

“I will be OK, and if I’m not, I’ll go down in history like Jack Daniels, some monarchs from many centuries ago, and some other people dying from an unusual circumstance.”

In addition to having several tattoos, Whelan has also sliced his tongue in half, removed his nipples to make room for them, colored the whites of both of his eyes black, and carved “teeth marks” into his ears.

His name has also been legally altered to “King Of Inkland King Body Art.”

However, it’s some recent throwback photos that the tattoo aficionado shared on Instagram that have tattoo enthusiasts buzzing.

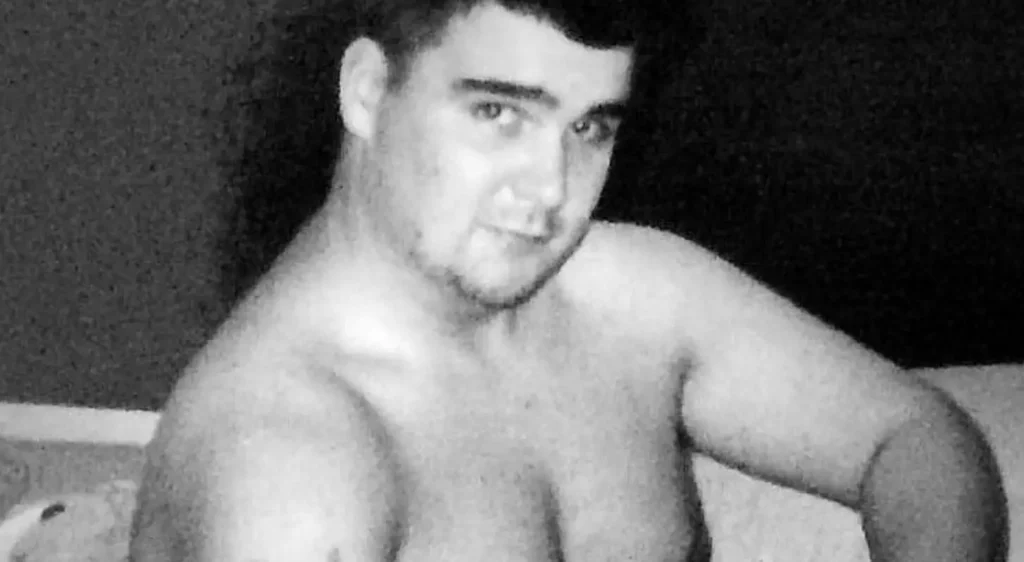

In one, he captions a picture of himself flexing his muscles with: “This is a throwback to the time of my skin only having one #tattoo. I was in better condition back then too and would have probably been on the wrestling team had we had one in high school.”

“Sporting off a British Bulldog on my right arm at the age of 16!”

One fan comments, “Hardly recognised you lol!”

In another shocking before picture, he writes the caption, “WHO [duck]-ing HECK IS THIS?”

“This foreign-looking guy was found in Cypress back in 1998 or 1999. I can’t actually remember just one of the many different faces of myself before the #tattoos. I was not a plain skin; I had my 1st, possibly 2nd and even 3rd #tattoo by this time.”

Risk reduction

Insurance protects against unforeseen events, mitigating the financial impact of occurrences such as automobile accidents, natural disasters, and health problems.

Financial stability

Insurance functions as a safety net, providing policyholders with funds to cover significant expenses in times of need, thereby ensuring a seamless recovery without financial strain.

Business continuity

Insurance compensates businesses for property damage, liability claims, and unforeseen events. This allows them to continue operations and maintain stability.

Lessen psychological stress

Knowing that one is protected by insurance reduces anxiety regarding financial losses and the unpredictability of future events.

Asset protection

Insurance protects valuable assets such as homes, vehicles, and personal property against potential damage and losses.

What is insurance and what are the benefits? Having insurance coverage gives individuals and businesses mental relief, knowing that they have a safety net in the event of unforeseen problems. It allows them to confidently plan for the future and navigate uncertain situations. Policyholders receive access to these benefits by sharing risks with insurance firms, which aid in their recuperation and growth in life.

Intentional damages caused by the insured or any other malicious behavior are not included in insurance coverage. The normal usage and aging of insured assets, such as machinery or motors, are usually no longer covered.

Medical expenses related to pre-existing illnesses may not be covered by your medical insurance plan.

Damages arising from acts of war, terrorism, or nuclear accidents are generally no longer covered by insurance regulations. Losses that occur outside the geographical scope or time period specified in the policy may also not be insured.

To avoid confusion during the claims process, policyholders should thoroughly read their policies and become familiar with the listed exclusions. While insurance is essential for protecting against various risks, these exclusions are necessary to maintain the integrity of insurance and prevent misuse of coverage.

Insurance companies may offer additional options or riders to help policyholders protect themselves from risks that are not covered by the basic policy. By understanding these limitations, both individuals and organizations can choose the most suitable coverage policies to meet their specific needs.

When individuals or businesses purchase insurance coverage, they enter into an agreement with the insurance company. This agreement stipulates that the policyholder will make regular premium payments in exchange for the coverage provided by the insurance policy. By doing so, the policyholder transfers the financial risk associated with specific activities or events to the insurance provider.

Upon accepting the policyholder’s premium payments, the insurer takes on the responsibility of reimbursing the policyholder for covered losses. The insurance company pools the premiums collected from multiple policyholders to create a fund that can be utilized to pay out claims when necessary.

This mechanism of sharing risk is crucial in the insurance industry. It allows individuals and businesses to safeguard themselves against potential financial hardships resulting from unforeseen events such as accidents, natural disasters, and health issues. Without insurance, individuals would bear the entire burden of economic losses, potentially leading to significant financial strain and difficulties in recovery.

To conclude, insurance companies assume the risk by providing financial protection and reimbursement to policyholders in the event of covered events. This transfer of risk mechanism offers policyholders the support they need to navigate uncertainty and recover from losses.

Do you still have questions? Be sure to get in contact with the insurance broker who sent this article to you, or refer to our Best of Insurance awards for help.

How about you? Do you think insurance is an important financial instrument? Use the comment section below to share your thoughts.